Giving Power Back to Your Users With Flow’s Account Model

Many alternative blockchains that have emerged recently are classified as “EVM” chains, meaning they operate exactly like Ethereum but have a different execution layer. This helps the cross-compatibility of smart contracts across chains, but it doesn’t solve some of the crucial problems embedded in the EVM system. In particular, it hasn’t improved how user accounts are handled and protected.

Flow, a layer-1 blockchain, is trying to change that pattern with its account model. In this article, we’ll look in detail at that new account model, how it works, and how it might be able to solve some of the most difficult UX problems in blockchain.

How Do Accounts on Ethereum Work?

One of the best ways to understand how the Flow account model excels is to compare it to Ethereum. There are two types of accounts on Ethereum: externally owned accounts (EOA), which are your typical consumer wallets, and then smart contract accounts.

EOAs have a public and private key pair, where the public key is derived from the private key and works as an address for the account, and the private key signs transactions on the blockchain. They can hold a balance and interact with other accounts, primarily smart contract accounts.

These smart contract accounts are compiled byte code that runs on the Ethereum Virtual Machine. What’s really interesting is that any data created by the smart contract, such as tokens or NFTs, is stored in that smart contract. Instead of an EOA truly owning the token, the smart contract simply says who owns what and how much.

Ethereum’s Potential Security Gaps

Not only is true digital ownership conceded, but smart contracts on Ethereum are hard to read and audit for security. A great number of scams and “rug pulls” have occurred on EVM chains because of this power imbalance. Such a scam would usually look like this: A website, which looks very similar to a popular NFT project, touts a new collection at a reasonable mint price. People visit the site, connect their wallet, and when they click that mint button, they will likely get a screen with a bunch of blockchain byte code that tells them nothing about what will happen if they sign. It could just mint an NFT, or it could completely deplete their wallet. Without the ability to read the transactions well, wallets are not able to give the end user much info as to what will happen when they sign. (Note that Flow, covered in more detail below, has a better transaction format that allows wallets to clearly tell the end user what will happen when they sign, giving more balance and control to the user.)

How Do Accounts on Flow Work?

The Flow account model combines the concepts of the EOA and smart contract accounts from Ethereum into a single standard. In this model, the account and the public keys are decoupled. As stated earlier, Ethereum accounts only have a public and private key, and they are tied to the account itself. This is important as it enables better control and reduces potential mistakes made by the end user, ultimately helping protect their assets.

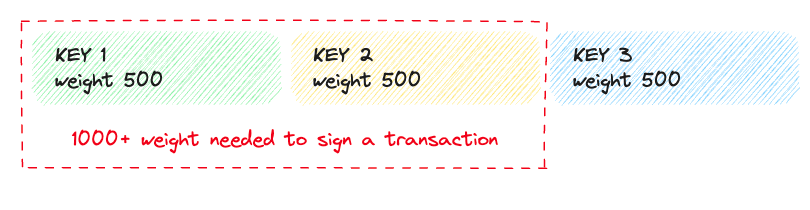

With the Flow account model, you can have a single account with multiple public and private keys. Having multiple keys is a huge advantage because you can revoke or rotate keys that might be compromised, again giving the user better control and security. Not only that, but these keys are weighted keys, giving them the ability to do more complex transactions, such as multiple signatures. These signatures are used frequently in blockchain to let multiple users sign one transaction, similar to how you might need two keys to open a bank vault. In the EVM model, this has to be built out manually, but with Flow, it is readily available.

Since there can be multiple keys for one account, the way Flow creates addresses is also unique. Unlike Ethereum — where addresses are derived from the public key — Flow account addresses are created with an internal on-chain checksum at the protocol level. This ensures addresses are unique.

In addition, Flow gives developers and users the option of different signature and hash algorithm curves, such as secp256k1 (used primarily by Bitcoin and other cryptocurrencies) or the more flexible P-256 (which is adopted by most cell phones and computers). These options provide better flexibility and compatibility with other protocols and ultimately give users top-notch security, all on devices they already use daily. And since encryption and cryptography are always evolving, it’s critical and necessary to adopt the latest standards.

Storage With Flow

Another thing unique to Flow’s account model is its storage capabilities. On Ethereum, only smart contract accounts have the ability to store data and thus truly own assets. You can think of it like leasing a car: if you lease one, you do get to drive it and park it at your house, but it's not truly yours. There’s a contract saying you own the car under certain terms, and the ultimate power is in that contract — and its terms may not always favor the lessee.

On the other hand, Flow accounts allow for asset storage and for accounts to deploy their own smart contracts. The account storage used is calculated by the byte size of data currently stored in the account, and it is directly tied to the balance of Flow tokens on the account.

True Digital Ownership: Buy, Don’t Lease

This is truly special as it gives users the ability to truly own the digital items they purchase, rather than a smart contract putting their name on it. Flow manages this storage by the number of Flow tokens the account has, including a minimum storage feed of 0.001 $FLOW, which equates to 100Kb of data. (This is to make sure it can handle any incoming assets.)

If, for any reason, the account attempts a transaction that would exceed its storage capacity, then the transaction will fail. In the Flow account model, that car is in your garage with no contracts tied to it! Paid in full.

Image courtesy of Flow Documentation

Conclusion

Flow is trying to diverge from the normal EVM path. In the Ethereum world, there are many cases of users losing funds partly due to the account model on EVM chains, which makes it difficult for users to read and interpret what will happen when they press a button on a website. Flow is aiming to empower users to own their digital assets and ensure funds will only leave their account with their permission. Flow also gives developers flexibility, making things like multi-signature weighted keys native to the platform, as well as multiple signature and hashing algorithms to choose from for the best compatibility among devices and networks.

It’s early, but these kinds of features are needed in web3 UX, and could be a potential game-changer.